I thought it is important to clearly understand some concepts related to inflation. Yield and inflation will affect dynamics of equity prices and dominate narratives of market in the short and mid-term. HEADLINE inflation: is a measure of the TOTAL inflation within an economy, including commodities such as food and energy prices (e.g., oil and gas), which tend to be more volatile and prone to inflationary spikes. Central banks’ goal is to maintain TOTAL inflation within their targets. Different countries choose different inflation targets, the practices are often based on maturity of their economies, culture of the countries etc.

CORE inflation (also known as non-food-manufacturing or underlying inflation): is calculated from a consumer price index minus the volatile food and energy components. Headline inflation may not present an accurate picture of an economy’s inflationary trend since sector-specific inflationary spikes are unlikely to persist, therefore operationally the central banks rely more on CORE inflation as a measure that feed into the basis of monetary policy adjustment.

(Market based) Inflation expectation: is the rate at which people – consumers, businesses, investors – expect prices to rise in the future. One widely used gauge of market-based inflation expectations is known as the 10-year breakeven inflation rate. The breakeven rate is calculated by comparing 10-year nominal Treasury yields with yields on 10-year Treasury Inflation Protection Securities (TIPS), whose yield is tied to changes in the CPI. The difference between the two approximates the market’s inflation expectations because it shows the inflation rate at which investors would earn the same real return on the two types of securities.

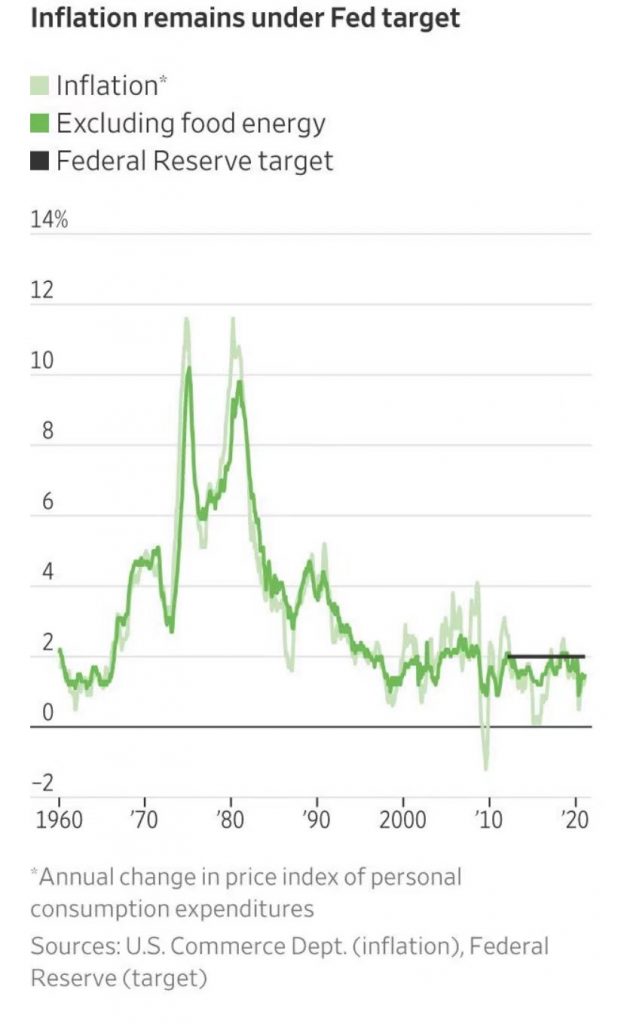

The Figure below shows the U. S. inflation data in the past sixty years. The high inflations in 70s and 80s impressed some economists nowadays and are raising their concerns of potential price hikes due to central banks’ large asset purchases and governments’ fiscal expansions. Note that inflation target was introduced in late 90s and became a mandate for central banks in most economies. Since then the inflations have been by and large under control in the U. S., Canada and in Europe as you can see from the figure for the U. S. part.