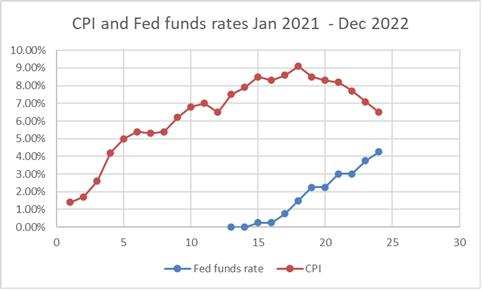

I don’t see any connection between inflation dynamics and federal funds rates from the chart attached at the end of this note. CPI in the US was peaked in June 2022 and fell down since then. The downward trend of the CPI has nothing to do with interest hikes by the Fed. Inflation responses to the monetary policies typically lag more than 12 months. CPI started to fall only five months after the Fed’s first rate hike, suggesting the trend is simply because of inflation its own dynamics – a supply/demand rebalance that was way before any impact from the monetary tightening.

Central banks are risking economic recessions unnecessarily by accelerating interest rate hikes. Between costly living with a job and without a job, the choice is obvious.